- What are the Financial Products – Pitfalls to which Depositors Turn.

- Dozens of court judgments for customers who were “misled” or not adequately informed about the high risk of the investment, resulting in hundreds of thousands of euros lost.

Reportage Data Journalists

Dozens of cases against banks have come before the courts in recent years concerning depositors’ investments in so-called “perpetual bonds”. These are complex financial products, which are even described as “high-risk” and in no way constitute a safe investment.

In other words, they are “rotten bonds” and the investor runs an increased risk of losing part of his capital without knowing it. The research carried out by Data Journalists shows that these products are usually made available by the private banking departments of banks to clients with high budgets. However, as shown by dozens of court decisions, customers were effectively “misled” or not sufficiently informed about the high risk of the investment, resulting in the loss of hundreds of thousands of euros. What is striking is that a number of convictions have been issued against the banks by the Greek judiciary, and fines have been imposed by the Securities and Exchange Commission. However, even today, the banks continue to encourage their customers to invest in this type of product by relying on the ignorance and trust relationships they have built up.

Invested EUR 220 000 in a high-risk product

In 2006, a private individual engaged in the food trade decided to invest a portion of the savings that had been kept for years in Alpha Bank. He had never been involved in what the financial market calls “high-risk investments”. Besides, he did not have the necessary knowledge of the functioning of the financial market and, in particular, of complex financial products. For these reasons, he did not want to invest in high-risk products, but “in products which would safeguard his capital (i.e., his savings) and which would yield a higher interest rate than that of fixed-term deposits”, as stated in a court decision published by Data Journalists.

Because he did not have the specialized knowledge required, he turned to an insurance consultant whom he knew from his cooperation with the company “EUROPEAN RELIANCE General Insurance Company S.A.” in order to guide him. The insurance consultant mediated to “EUROPEAN RELIANCE Finance Investment Services Corporation (S.A.)” in order for the individual to contact a manager. As it was done.

On February 26, 2006, the individual started to cooperate with “EUROPEAN RELIANCE Finance Investment Services Corporation (S.A.)” by signing a contract for the provision of investment services. Shortly afterwards, the manager proposed to him “to invest his capital in a deposit product offered by the company”. However, he was assured that “in this deposit product his capital would be guaranteed”.

ALPHA BANK GROUP bank bond

Specifically, the insurance advisor proposed to the individual the purchase of a bank bond issued by “ALPHA BANK GROUP”, with the details “Alpha Group Jersey Limited Series B”. This bond had a Fitch BBB+ credit rating, with a high-interest rate and a “possible recall option on 18-2-2015”. The insurance advisor informed the individual that “the capital of their investment would be guaranteed 100%, and that the investment in this bond would be zero-risk in terms of the invested capital.

The individual was convinced and decided to invest his savings in the above product. Thus, on February 28, 2006, he purchased the bond for 220,000 euros.

However, things turned out differently. On April 25, 2012, “EUROPEAN RELIANCE Finance Investment Services Corporation (S.A.)” sent a letter to the individual, informing him that “ALPHA GROUP LIMITED”, i.e., the issuer of the bond, was going to repurchase these securities. The only difference was that the repurchase would be at a price 55.31% below its nominal value. The private party was obliged to accept the proposal, which resulted in a loss of EUR 105,006 and a commission of EUR 5,550.

“Perpetual bond”

However, as underlined in the court decision published by Data Journalists, “EUROPEAN RELIANCE Finance Investment Services Corporation (S.A.)” “never informed the investor about the nature of this bond”. That is, that this investment involved risks and that his capital was not guaranteed.

More specifically, according to the court decision, the private investor was never informed that the bond he was investing in was due to expire on 28/02/2049 so until then he could not seek and liquidate the capital of his investment except on the secondary bond market.

“Thus, the investor did not know or receive the required information about the risk he was taking by investing in the above bond, believing, in any case, that his capital would be guaranteed”, as underlined.

In fact, the product in which the individual invested was not a regular bond but a “perpetual bond,” meaning a bond with no fixed maturity date, also known as a “perpetual” or “indefinite-duration bond”. These are highly complex products that “constitute bonds” issued as securities in the context of a bond loan by a public limited company or a State. In order to follow their course, one needs to have a piece of specialized financial knowledge.

“.. Therefore, it is obvious that perpetual bonds are not simply investment products in their issuance and operation, so that the investment services provided by public limited companies are subject to a particularly high obligation to inform their individual investor clients, given that the use and circulation of perpetual bonds as bonds, a bond loan, conveys a false, virtual image, capable of misleading anyone, even the most knowledgeable investor, as to their legal nature and function (DN 354/2022, DN 536/2019)..” is typically noted in a number of judicial decisions.

In this case, the individual filed a lawsuit in 2012 against the companies “European Reliance Asset Management Company S.A.” and “EUROPEAN RELIANCE General Insurance Company S.A. In 2019, the final decision No. 2646/2019 of the Athens Single-Member Court of First Instance was issued, by which the lawsuit was dismissed. In February 2021, the individual filed an appeal against the first instance decision. The Athens Court of Appeal issued decision number 1721/2023, which obliged EUROPEAN RELIANCE Asset Management Company S.A. to pay him the amount of 105,006 euros as compensation. It is another court decision against the Bank for its investment practices.

Bonds “deathtraps” for a total value of EUR 271,000

In February 2005, a private individual decided to invest an amount of EUR 274,000 from his savings. As he was working with NOVA BANK (renamed “MILLENIUM BANK”) he approached the bank’s employees in order to seek investment advice. Meetings and discussions of an informative nature followed. In April 2005, the cooperation between them started by signing a “limited mandate agreement on a portfolio and an application for the opening of a trading relationship”. Indeed, as stated in the decision, the Bank classified the investor’s profile as a “Preservative Portfolio”, i.e., a portfolio composed mainly of short-term investments and fixed-income securities”.

In the same month – April 2005 – the Bank’s representatives proposed to the individual to buy seven bonds with a total nominal value of 271,000 euros. The first of these, issued by CASINO GUICHARD PERRACHON SA, with a nominal value of EUR 125,000, with a call date of 20.01.2010; the second, issued by EFG HEILAS FUNDING LTD, with a nominal value of EUR 26,000, with a call date of 18.03.2010; the third, issued by EUROHYPO CAP FUND, with a nominal value of EUR 25,000, with a call date of 08.03.2011. The fourth was issued by BA-CA FINANCE CAYMAN LTD, with a nominal value of EUR 25,000, with a call date of 22.02.2012. The fifth was issued by BA-CA FINANCE CAYMAN LTD, with a nominal value of EUR 23,000, with a call date of 22.02.2012. The sixth, issued by NBG FUNDING, with a nominal value of EUR 25,000, with a call date of 16.02.2015, as well as a bond issued by ALPHA GROUP JERSEY LIMITED, with a nominal value of EUR 25,000, with a call date of 18.02.2015.

The employees presented the bonds “as highly advantageous products that fitted his investment profile, with a guaranteed payment of the principal at maturity of each bond and a high-interest yield”. Indeed, in order to convince him to proceed with the investment, they agreed to grant him a loan for the same amount as collateral for the bonds.

Victim of Deception by the Bank

At first, everything went smoothly.

The investor received regular written updates of the bond account from the bank. In March 2008, he was notified of the regular monthly statement of his investment (“WEALTH MANAGEMENT STATEMENT”) dated 29.02.2008. To his surprise, the individual found that the bonds he had purchased contained “changes in the original call-maturity dates”. For example, the bonds issued by “CAZINO GUICHARD PERRACHON” were listed as having a call-maturity date of 20.01.2049, while the bonds issued by “EFG HELLAS FUNDING LTD” were listed as having a call-maturity date of 18.03.2049. The same maturity dates of the bonds were mentioned for the other products he had purchased. Simply put, the investor could not “break” or sell the bonds earlier. Something he didn’t know before he invested.

The individual requested an explanation from the Bank. His wife then sent an extrajudicial statement requesting the Bank to take a series of actions, “claiming that it had breached its obligations under the contract it had signed with its franchisor and the legislation in force”. In particular, the wife requested payment of the sum of EUR 125,000, representing the value of the bond issued by “CAZINO GUICHARD PERRACHON”, and the sum of EUR 26,000, representing the nominal value of the bond issued by “EFG HELLAS FUNDING LTD”. She also requested payment of the nominal value of the other bonds on their maturity date.

The Bank replied in August 2010 that “her husband had been fully informed in advance about the content of the investment and the complex nature of the above bonds and the investment risks arising from them” and “refused to take the requested actions, describing the plaintiff’s claims as unfounded”.

Another vindication in the courts

According to the court decision, the individual had been the victim of a “misrepresentation” as to the true nature of “perpetual bonds as investment products and the essential terms of these bonds, namely the existence of a specific maturity date”. The Bank’s representatives never informed him that the bonds which they proposed to invest in belonged to the category of “perpetual bonds”. The Bank was under an obligation “to make absolutely clear to the investor before he gave the order to invest, the legal nature and function of the bonds in question”. It failed to do so, with the result that it had “a completely incorrect view of the bonds” and suffered a “loss”.

The same decision refers to the “unconventional and illegal behavior” of the Bank’s representatives and “breach of its commercial obligations”.

In 2011, the wife of the individual filed a lawsuit against the Bank at the Athens Court of First Instance. In 2016, the Court of First Instance ruled that she should be compensated by the Bank for the damage she suffered. The decision of the Athens Trial Court of Appeal issued in 2019 ruled the same. Piraeus Bank appealed against the Court of Appeal’s decision in May 2019, asking for it to be overturned. Finally, the Supreme Court in its decision number 1185/2021 rejected Piraeus Bank’s appeal.

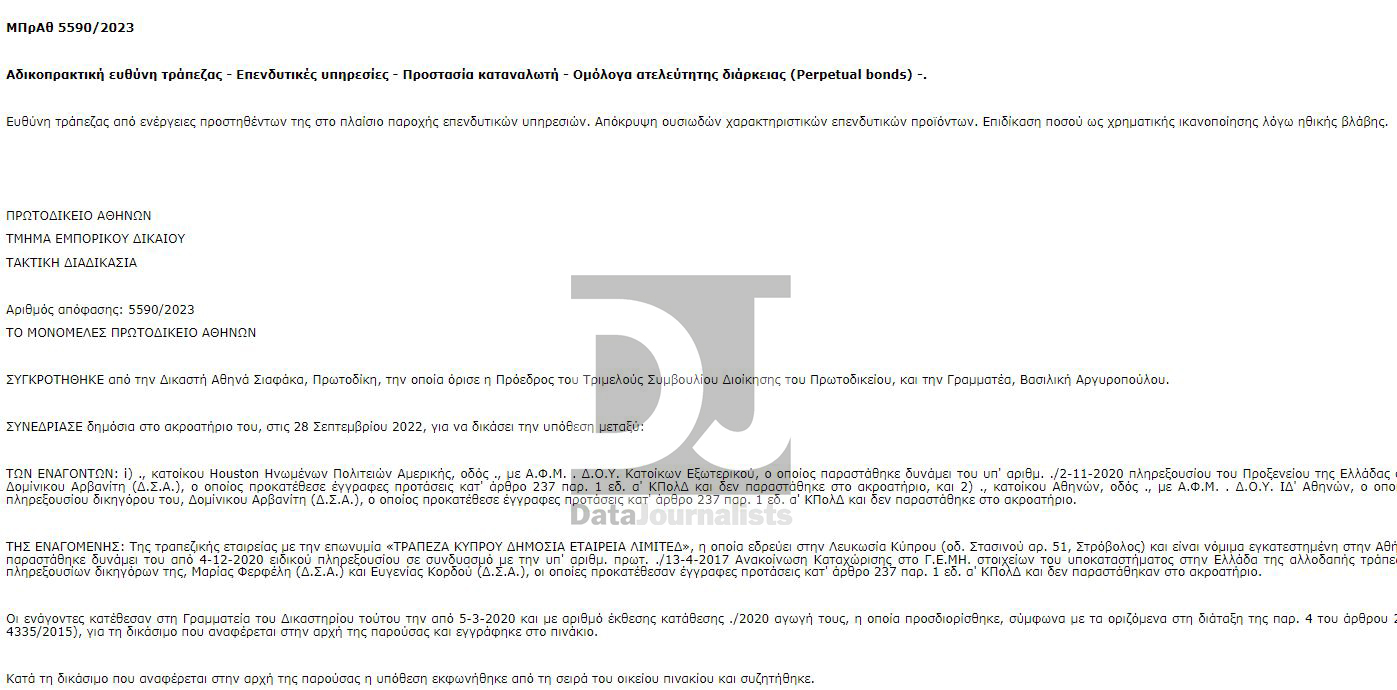

High-risk investments by the Bank of Cyprus

Another case is that of an individual who in 2008 decided to convert part of his savings held at “BANK OF CYPRUS” into Convertible Securities. Specifically, the individual was persuaded by the bank’s branch employees to convert some €105,000 into securities. Indeed, the individual accepted. Moreover, the employees presented “the bank product in question as a preferential term deposit”.

Thus, in July 2008, the individual signed ‘two irrevocable applications for the registration of unused Convertible Debentures, for an amount of EUR 52,500 each”. The investments were continued in 2009 by a relative of the individual, at the instigation of a branch manager of the Bank. According to the court decision, the manager assured them that the Convertible Capital Securities, “had main characteristics similar to those of a fixed-term deposit, namely an assured return of capital at the end of five years and attractive interest yields”. As a result, in 2009 the individual converted the Convertible Debentures of EUR 105,000 he held into Convertible Capital Securities of the same value, while his relative invested a further USD 200,000 in the same product two years later.

In June 2012, the Bank of Cyprus cancelled the payment of interest to the holders of these investment products due to a capital shortfall. Shortly afterwards, the Bank of Cyprus was placed in “special liquidation” and a “haircut” was imposed on deposits and bonds. In addition, the Bank decided to convert the Convertible Enhanced Capital Securities into Class D shares with a conversion price of one euro. The unconsolidated shares were cancelled and the nominal value of the cancelled shares was used to write off the Bank’s accumulated losses. As a result, the two individuals who had invested in the CAPMs suffered losses of hundreds of thousands of euros. The Bank informed the holders of the events in August 2013.

They lost about 330.000 euros

Due to the depreciation of the value of the Convertible Enhanced Capital Securities, which, as mentioned earlier, were of reduced collateral, investors incurred a total financial loss of 330,000 euros (the first 223,427 euros and the second 105,000 euros).

As noted, these are complex financial products, intricate in their issuance and operation, representing unsecured and lower-priority obligations of the defendant, associated with a multitude of general and specific risks not only for the interest rates but also for the invested capital.

“These were investment products which were designed as “loss-absorbing instruments” for the defendant bank, in particular, the Contingent Capital Securities (CCS) and, in particular, the Convertible Enhanced Capital Securities were a protective instrument (“cushion”) designed to absorb the particularly high losses incurred by the defendant bank as a result of its excessive exposure to the G.G.B.”, the possibility of which was foreseeable and undoubtedly known to the defendant bank’s executives”.

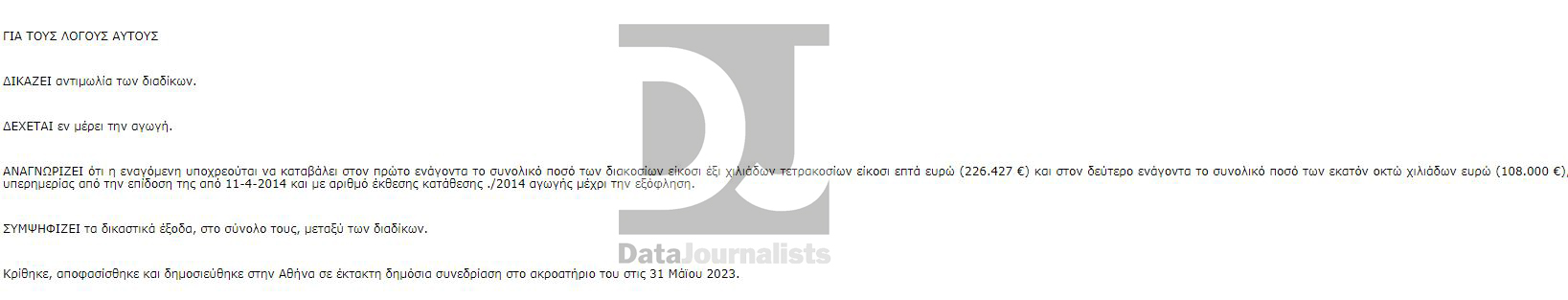

In 2020, the two investors, now US residents, filed a compensation claim against Bank of Cyprus, later Piraeus Bank. The plaintiffs alleged that the bank was liable in tort for providing investment services and, in particular, that it had concealed material features from investment products. The Athens Court of First Instance, in its judgment 5590/2023, ordered the payment of damages of EUR 226,427 to the first applicant and EUR 108,000 to the second applicant.

Discussion about this post