- Data Journalists bring to light the Authority’s decision describing “distortion of competition” in favor of this particular company by the inter-municipal body of Central Macedonia that is commissioning the project.

By Aris Hadjigeorgiou

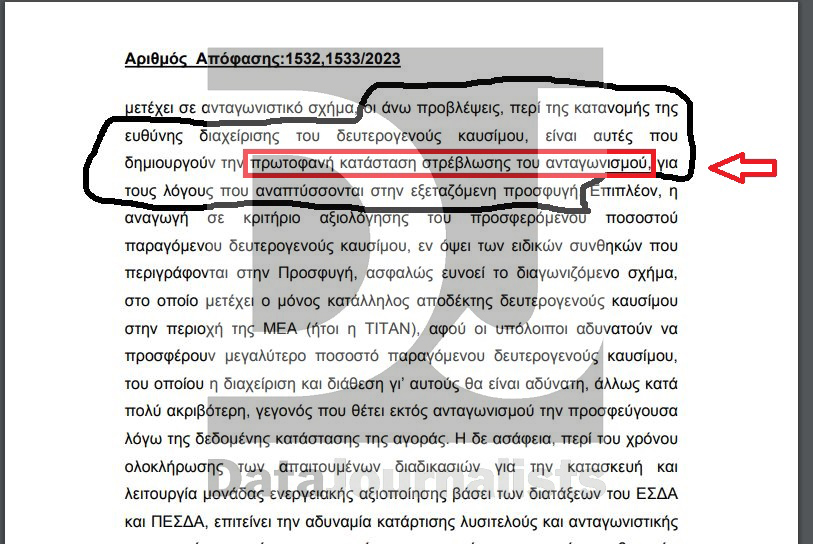

How can a “competitive dialogue” lead to an “unprecedented situation of distortion of competition” (HERE) in favor of the powerful construction company TERNA? The answer to this question is given by a decision of the Hellenic Single Public Procurement Authority (HSPPA) on a €250 million waste management project near Thessaloniki. The Authority’s decision is a condemnation against the inter-municipal body of Central Macedonia that awarded the project as it describes methods of “distortion of competition” (HERE) in favor of this company which, with its general dominance in all forms of contracting, has come to accumulate a huge backlog of project and investment contracts (officially 5.7 billion euros) that even threatens their implementation.

The decision of HSPPA revealed by Data Journalists calls for the annulment of the specific tender procedure through a “competitive dialogue” that started in 2021 with the Regional Association of Solid Waste Management Agencies of Central Macedonia (FODSA). FODSA has undertaken the award and implementation of a project that has been announced many times by the government and is the Waste Treatment Plant (WTP) of the Western Sector of the Region of Central Macedonia. The plant will be built outside Thessaloniki, near the Mavrorachi landfill site, and is one of dozens of facilities where the government promises to process waste. The stated goal, as the responsible Secretary General of the Ministry of Environment and Energy Manolis Grafakos (who remains in his position despite the changes of three ministers since 2019) says at every opportunity, is for this processing to produce recyclable materials, compost (biowaste) and materials that will be led to combustion – or as the government prefers to call it, “energy recovery”.

- Here it seems that lies the root of the whole scheme… Who and how will burn the fuel produced from the garbage? The fuel changes depending on the technology used. It is treated differently if it is to be burned in a cement factory and differently, if it is to be used in a power plant. The bottom line: in Greece, there are only cement works that already burn waste fuels in relatively small – for the moment – quantities, in Volos and elsewhere. Something else that is also important: It matters how close to the Waste Treatment Plant the cement plant will be in order to avoid the transportation of thousands of tons of fuel being too expensive. Another crucial question: Who will decide where the waste fuels will be burned? Will it be the FODSA or the project contractor?In this particular tender, however, something was revealed along the way that was not known from the beginning. The FODSA was assigning this responsibility to the contractor. Thus, favorable conditions were created for TERNA, which is in partnership with TITAN, which has a cement production plant in Eukarpia in Thessaloniki, i.e., very close to the Waste Treatment Plant. On the basis of this “privilege”, as accepted in the HSPPA decision, this partnership can achieve lower costs, ask for a lower price, and win as cheaper the exploitation of the WTP for 27 years.

All of the above is described in detail in the 50-page decision of the HSPPA. There are even points where, among the complex and formal legal formulations, arguments, and rebuttals, there is a clear and unambiguous reference to photographic provisions, incompatibilities, and “unfair” (HERE) and “impermissible competitive advantage” (HERE) in favor of TERNA. In the tender for this 300,000 tn processing project, four other interested parties are participating in addition to the TERNA-TITAN partnership:

- AKTOR-HELEKTOR

- MOTOR OIL-AVAX-THALIS

- MYTILINEOS-MESOGEIOS

- INTRAKAT

The 50-page decision of HSPPA (pdf )

Two of the interested parties, AKTOR-HELEKTOR and MYTILINEOS, filed preliminary appeals to the EADESY last August. The E Chamber of the Authority met on the appeals on 10/10/23 and issued a decision on October 30.

There, inter alia, it was stated that:

- AKTOR-HELEKTOR requests the annulment of the Invitation to Tender Phase B – Stage B.II of the contested tenders and MYTILINEOS requests the annulment in its entirety of the invitation of 21.07. 2023 Invitation to Tender and the draft Partnership Agreement and, in any event, the conditions under which the responsibility for the management and disposal of the secondary/waste fuel is entrusted to the contractor Private Partnership Entity (PPI).

- In general, the appeals are directed against decisions taken by the FODSA in July 2023 as they changed the data compared to the original decisions when the tender was launched in the early stages of 2021. Commenting, the decision states that under Law 4412/2016, “contracting authorities shall treat economic operators equally and without discrimination and act in a transparent manner, respecting the principles of proportionality, mutual recognition, protection of public interest, protection of private rights, freedom of competition and protection of the environment and sustainable and viable development. Procurement procedures shall not be designed […] to artificially restrict competition. Competition shall be deemed to be artificially restricted when procurement procedures are designed to unduly favor or discriminate against certain economic operators.”

- It is also stated that “the terms of the contract documents must be clear and complete so as to permit the submission of tenders which are valid and comparable with each other. Technical specifications shall ensure equal access for economic operators to the procurement procedure and shall not have the effect […] of favoring or excluding certain undertakings or certain products”.

- “Regarding specifically the scope of the project, this was first defined in the “Call for Proposals – Phase B – Stage B.II”, in July 2023. Whereas the Phase A Call in May 2021 stated that the private partnership operator “will be responsible for part or all of the secondary products”, the Phase B Call – Stage II. II and specifically in Part 3 of Annex 5A of the Partnership Agreement it is now (definitively) provided that “it is the obligation of the PPI to manage and/or sell the secondary products of the treatment of the Conventional Waste and in particular: – The other Secondary Products (refuse derived fuel and, if produced, energy and compost derived from the mixed municipal waste”.

- In the decision, HSPPA ruled that FODSA‘s arguments are consistent with AKTOR-HELEKTOR‘s assertion that “the volatile economic conditions cannot ensure the long-term disposal of waste fuel to the cement industry and that it is necessary, the management of secondary waste should be carried out by the Contracting Authority so that it is possible to absorb secondary fuel in terms of quantities, specifications, and prices in the long term”.

- Elsewhere, FODSA claims that the binding requirements were subsequently provided for by Law 4819/2021 and the revised study of the Regional Waste Management Plan (Waste Management Plan of Central Macedonia) in 2023.

HSPPA rejects the claim, stating that the Regional Waste Management Plan (RWMP) foresees that “to achieve the goals of minimizing landfilling, the processing residues, as well as the produced refuse-derived fuels, will be directed to an energy utilization unit with thermal treatment under the responsibility of the Ministry of Environment and Energy or another competent authority designated by law, possibly in combination with the use of refuse-derived fuels in energy-intensive industrial installations, to the extent that the latter is deemed appropriate.” Therefore, the RWMP document clearly specifies that waste management should be carried out by the Contracting Authority.

- It also rejects as unfounded the assertion made by FODSA that “any waste management by the contracting authority would, on the one hand, entail delays due to the obligation to conduct frequent tenders and, on the other hand, make the PPI and the operation of the plant dependent on the actions of a third party, with all the subsequent consequences for the planning of the production of the PPI on the basis of the planning for the disposal of the fuel and its quality requirements”.

This is because the Contracting Authority has the discretion to determine the terms and duration of the contracts to be put out to tender (hence the frequency of tenders), as well as the more specific parameters of contract performance between different contractors, according to its needs from a quantitative and qualitative point of view.

- AKTOR-HELEKTOR “admissibly contested at this stage of the Tender the “photographic nature” (HERE) of the terms of the Call for Tenders that provide for the management of secondary waste by the private party, as it was first finalized with the Call for Tenders Phase B – Stage B.II and which terms allow the participation in the Tender only of the TERNA-TITAN ASSOCIATION”. In fact, it is added that the project is a Public-Private Partnership (PPP) and therefore part of the investment is undertaken by the private party, therefore “ensuring the availability of secondary fuel is a key parameter of bankability by potential lending banks and, therefore, a key parameter of the project and a key element in the formulation of the Binding Offer”.

- Elsewhere, the contracting authority claims that “the management of waste fuel is not limited to one company or one installation” and is not limited to the production of cement “in Thessaloniki (i.e., TITAN) and Volos (Lafarge)”.

(ΘΑΝΑΣΗΣ ΚΑΛΛΙΑΡΑΣ/EUROKINISSI)

It also claims that since there are imports of waste fuel from England and Italy, this “proves that there is a great demand in the Greek market and indeed it is viable to use alternative fuel from energy-intensive cement industries”.

HSPPA is not convinced by the argument, saying that “according to the lessons of common experience, the other Greek cement plants, which are further away than those of Volos and Thessaloniki, would be more economically unviable”.

- Elsewhere, FODSA claims that in other Treatment Plants already operating (Western Macedonia, Serres, Epirus, Peloponnese, Ilia), the management of secondary products belongs to the private party (i.e., again TERNA which has taken over Epirus-Peloponnese). “It is irrelevant how this condition was assessed in other tender procedures”, the decision states and adds that “in the above PPP contracts relied on by the contracting authority, no waste fuel was produced”.

- Characteristic is the reference in the decision of the HSPPA that the incompatibility of the participation of TERNA-TITAN “and the granting to it of an unfair competitive advantage (HERE), arose as an automatic consequence of the assignment of the responsibility for the management of the secondary fuel to PPI, which was made binding, first, by the contested Call for Tenders”.

In response to MYTILINEOS’ argument that there is a “distortion of competition in the specific circumstances (since only TITAN is located in the vicinity of the project and can receive the waste fuel, which is nevertheless part of a competitive scheme)”, the contracting authority replies that “the applicant is attempting to adapt the terms of the tender to its own needs”.

However, the HSPPA has ruled that the conditions imposed “entail an impermissible competitive advantage in favor of only one participant to the detriment of the others and in any event of the applicant, which is deprived of the right to maintain the secrecy of its bid and to submit a competitive bid”.

- In response to the Contracting Authority’s argument that there are more “alternative” options for the disposal of refuse-derived fuel, HSPPA states that “the cement industry is currently the only suitable recipient of secondary fuel since it is the only industry that has made investments and infrastructure for the treatment of emissions from the combustion of SRF and is licensed to do so”.

- HSPPA refutes the argument that the secondary fuels could be distributed to neighboring countries such as Bulgaria. This “demonstrates, on the one hand, the validity of the allegations that the market conditions are such that there are no alternatives capable of ensuring equal treatment of economic operators and, on the other hand, the fact that the only association that can respond to this requirement at low cost and makes a very realistic and viable offer is the association TERNA – TITAN“.

It also rejects the claim that such fuels are imported into Greece as this “leads to the conclusion that, in the countries of origin, the facilities that meet the requirements for SRF combustion are minimal, which leads to the disposal abroad, with exorbitant transport costs”.

- “With its claims, the Contracting Authority asserts that the tenderers have to take into account, for the formulation of their offer, “long-term” assumptions and that it is not obligatory to foresee the disposal in energy recovery plants, since they can turn to plants in the country “or abroad” for the disposal of the secondary fuel, the contracting authority concedes that the conditions laid down are favorable to TERNA – TITAN“.

After the decision of HSPPA to annul the decisions of the Central Macedonia FODSA, the future of the tender for the WTP remains unknown. It is very likely that an appeal will be filed or that the courts will take over so developments will take time.

In any case, this decision is in its own way indicative of the strength of TERNA which has managed in recent years to acquire a fully leading role in public works, PPP projects, concessions, and energy investments.

According to the official financial results of GEK-TERNA Group for the first half of 2023, the construction backlog reached an all-time high of EUR 5.7 billion. In other words, the company has undertaken to execute and finance projects of this amount, having 1.44 billion in cash on hand and debt obligations exceeding 3 billion.

The backlog will soon reach 8 billion on the basis of pending contracts. It is recalled that TERNA is involved in huge projects such as the new airport in Kastelli, Heraklion, Crete, and the Integrated Tourist Complex in Hellinikon.

As of 2021, TERNA has been announced as the contractor to take over Egnatia Odos but the contract that will oblige it to pay the €1.5 billion price has not yet been signed. In this case, TERNA claims that the government is responsible for the delay, while many argue that the transfer was put on hold during the pre-election period because it would also lead to the imposition of very expensive tolls.

More than 3.2 billion will be required for TERNA to acquire Attiki Odos, for which it has submitted a mammoth bid, while it is seeking to take over the rest of the Northern Road Axis of Crete (BOAK), which will also require more than 1.7 billion, as well as a role in the extensions of Attiki Odos, worth more than 1 billion euros.

RELATED ARTICLE: Attiki Odos demands 200 million euros from the Greek state

(ΘΑΝΑΣΗΣ ΚΑΛΛΙΑΡΑΣ/EUROKINISSI)

Referring to the concerns raised by the giant backlog and the obligations it creates, the head of GEK-TERNA Group, G. Peristeris, has argued that most of it comes “from the group’s lower-risk construction projects”, stressing that “in third-party projects as well, the group’s efforts are focused on making contracts more secured with clauses and protecting the company from sharp fluctuations”.

All this, at a time when the construction industry in general is complaining that the government is delaying decisions to ensure that the cost of projects reflects the reality of the skyrocketing international prices of materials.

Other major construction companies have high backlogs but the “burden” of GEK-TERNA is far from being met. GEK-TERNA has recently been forced to refute reports that point to cash constraints due to the high liabilities it has undertaken and imply an unwillingness of banks to continuously provide guarantees to the company.

Discussion about this post